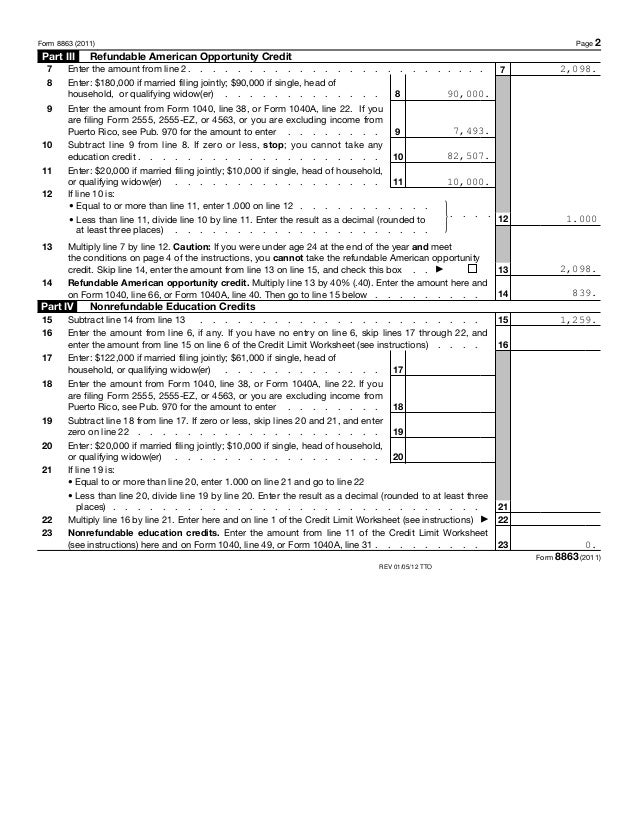

We strive to translate IRS-speak into simple and relevant articles that provide you with the information you need - when you need it. Find out how to file your federal and state taxes easily, accounting or tax advice. This blog is for informational purposes onlyand does not provide legal, quickly and most importantly - accurately. The IRS has informed us and other impacted providers that they are currently processing these returns. This review process means the IRS may need 4-6 weeks from this date to issue a refund. The office or customer service agent will be able to serve you and provide next steps.H&R Block appreciates that this issue may cause problems for our clients and we are doing everything in our power to address the processing of these returns. We will continue to update clients as more information becomes available. Lifetime Learning credit for tuition. You can claim it for books and supplies ONLY if they are required to be purchased from the school, financial, and only if you MUST purchase them in order to enroll and register for the class. I am hoping someone can help though. I got stuck filing the 8863 education credits form before the IRS pulled their little stunt. I am having a heck of a time trying to find a date of when these returns will be done. I filed on 1/26 and have yet to even be acknowledged. Mid-February. At that point they will start excepting the tax returns with an intisipated refund date of early March. Hope this helps.I have never posted to one of these forums before. I am hoping someone can help though. I got stuck filing the 8863 education credits form before the IRS pulled their little stunt. I am having a heck of a time trying to find a date of when these returns will be done. I filed on 1/26 and have yet to even be acknowledged.