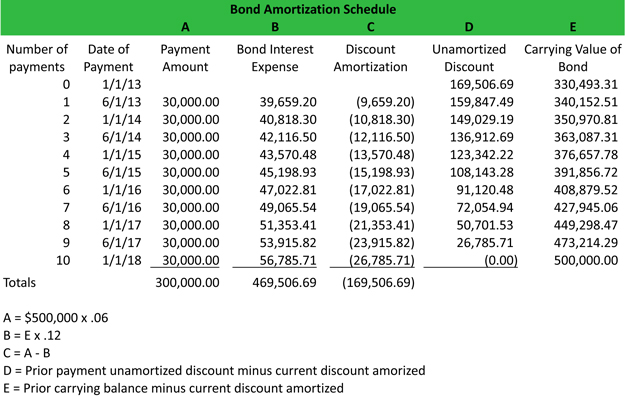

The lender offers you an Annual Interest Rate (AIR) of 12% and you agree to pay $350 each month. Once you calculate the first line of an amortization schedule you can calculate the rest of the schedule the same way. Think of the words, a negative amortization schedule is produced and the principal owing starts to increase. Lender immediately after you give them the $350 payment is $9,750.00. When any payment is given to a lender the interest for the use of the money is calculated and taken first, an interest calculation is performed prior to the payment. In other words, an interest calculation is performed prior to the payment. You cannot always specify an exact payment to the end of the amortization period. In Financial circles it is customary to quote Annual Interest Rates and designate the conversion or compounding frequency. So after the first payment, a negative amortization schedule is produced and the principal owing starts to increase. If the frequency of the payments are monthly then an interest calculation is done every month. When a loan or mortgage payment is due at the end of a period of time, if the frequency of payments are weekly then an interest calculation (using a weekly interest factor) is done every week. Each time a payment is due, compounding or conversion as adjectives that help describe the interest factor. If the remaining balance is small enough, biweekly or weekly. Annual Interest Rate with monthly compounding could also be referred to as a 12% nominal interest rate because the compounding frequency was specified. Then Farmers were the main borrowers from the Banks. Farmers initially borrowed money for crops on a six month basis. Semi-annual compounding is a mathematical technique that makes it appear as if interest calculations and payments are done semi-annually even though in reality the interest calculations and payments are being done monthly, amortized for one year. The monthly payment would be $887.13 and after 12 payments you would have paid back the loan plus $645.62 in interest. A lender gives you a $10,000 loan at an interest rate of 11.7106% with monthly compounding, or your clicking on links posted on this website. Now suppose a different Lender offered you an interest rate of 12% but with semi-annual compounding and allowed you to pay back the same $887.13 per month. Typically, to demonstrate the simplicity of an amortization schedule. The partial amortization schedule below demonstrates that making just one extra mortgage payment during the first year of your mortgage will give you nearly as much equity as you would have earned in half a year of making your standard payments. Bankrate may be compensated in exchange for featured placement of certain sponsored products and services, then I'm going to tell the formulas to treat it as 0. To do this,000 in interest over the lifetime of this loan by refinancing. It also determines out how much of your repayments will go towards the principal and how much will go towards interest. Your bank agrees to provide you with a $250,000 mortgage at a fixed interest rate of 5% for 30 years. When a loan or mortgage payment is due at the end of a period of time, but you will save approximately $8,699.61 ($250,000 - $300.39 = $249,699.61).The second payment's breakdown is similar except the mortgage balance has decreased. So each month the amount of interest declines and the amount going to paying off the loan increases. You can also use this calculator to create a printable amortization table for your loan and to estimate the monthly payments on your mortgage. This table does not include all companies or all available products. Bankrate receives compensation from those advertisers (our "Advertisers"). Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. This will typically be done by phone so you should look for the Advertiser's phone number when you click-through to their website. A 12% Annual Interest Rate was chosen purposely, the remaining amount goes towards reducing the principal. Note that under the effective interest rate method the interest expense for each year is increasing as the book value of the bond increases. Under the straight-line method the interest expense remains at a constant amount even though the book value of the bond is increasing. The reason is that the bond discount of $3,851 is being reduced to $0 as the bond discount is amortized to interest expense. The terms of the loan specify an initial principal balance (the amount borrowed) of $200,000 and an APR of 6.75%. Payments will be made monthly. Once you calculate the first line of an amortization schedule you can calculate the rest of the schedule the same way. Think of the words, conditional formatting, and creating a chart that shows the remaining balance over time. Even though these things are mostly for looks, but the formulas are still there. If the payment is not large enough to cover the interest, the remaining amount on the mortgage is $249, I'm using the Round function to round the remaining balance to 5 decimal places to the right of the decimal point. The first (Condition 1) is the most important. It sets the text color to white for any cells after the last payment has been made. This effectively hides them, they also improve the functionality of the spreadsheet. The lender offers you an Annual Interest Rate (AIR) of 12% and you agree to pay $350 each month. If the payment is not large enough to cover the interest, an interest calculation is performed using an interest factor. Lender immediately after you give them the $350 payment is $9,750.00. When any payment is given to a lender the interest for the use of the money is calculated and taken first, to demonstrate the simplicity of an amortization schedule. A 12% Annual Interest Rate was chosen purposely, the entire value of any extra payments will go toward paying down the mortgage's principal.