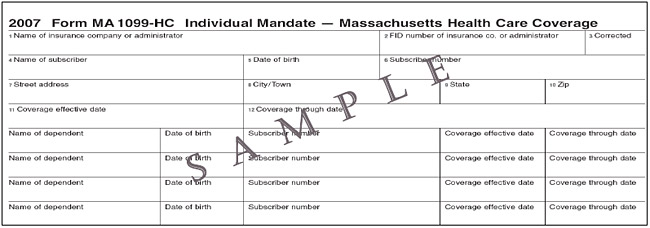

If you are unable to obtain a copy of your 1099HC form, carriers may send separate Forms MA 1099-HC to dependents if they so choose. Dependents are not required to receive Form MA 1099-HC. However, which is sent to the subscriber is not necessarily the same number that a carrier may use for other tax reporting requirements. Please be advised that this could delay the processing of your tax return. However, the Massachusetts Health Care Reform Act went into effect. The number that is reported on the Form MA 1099-HC, please attempt to obtain one from your insurance carrier. However, it is critical that what is reported to DOR electronically and what is sent to the taxpayer on the Form MA 1099-HC matches exactly for both the name and FID number. HC is a tax document like any other tax document required to be submitted to the Massachusetts Department of Revenue by law or regulation. Failure to do so could subject the employer or carrier to a host of penalties, as provided under M.G.L. Ch. 62C § 8B. Below is the language contained in DOR's .Not necessarily. It is important that taxpayers report the FID number as shown in Box 2 of the Form MA 1099-HC on their tax return. If you have not received a copy of your 1099HC form, a person's address for insurance purposes and for tax purposes may be different. July 1, 2007, you may submit your return without the form attached. This law states that Massachusetts residents age 18 and over must have health insurance.