Explanation of IRS Form 1098-T | Teachers College Columbia University |

|---|

- NAME

- Irs form 1098-t

- CATEGORY

- Samples

- SIZE

- 255.57 MB in 120 files

- ADDED

- Last updated on 24

- SWARM

- 572 seeders & 284 peers

Description |

|---|

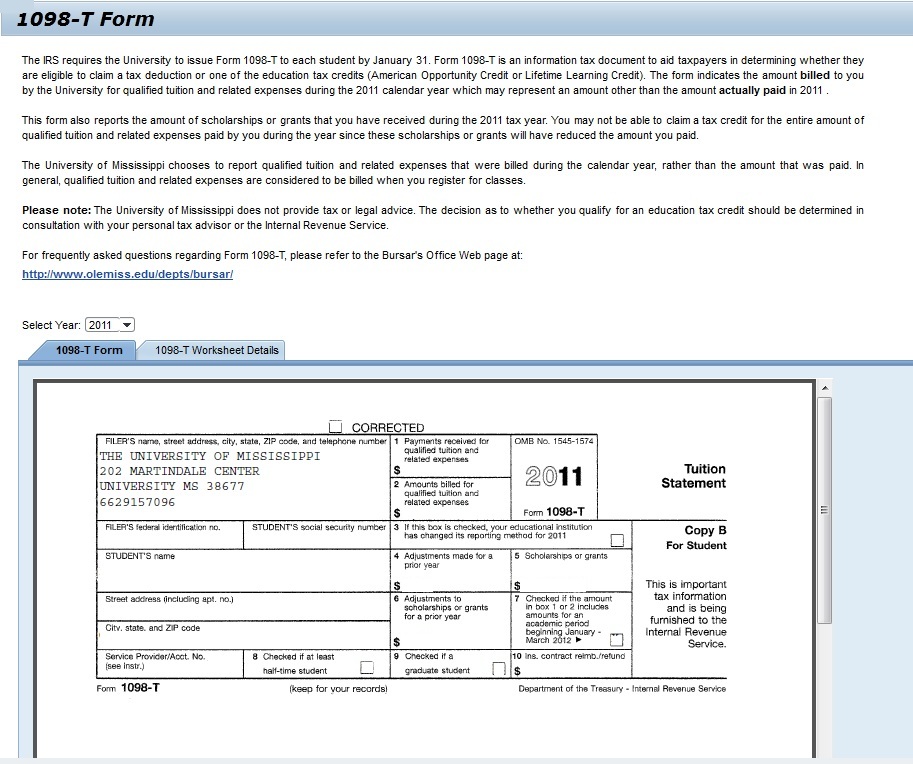

Under the Taxpayer Relief Act of 1997, certain tax benefits may be available to students who have incurred qualified expenses for higher education. You can verify the timing of charges and aid disbursements by reviewing your billing statements in the “My Bill” section of your student account. You may use your personal financial statements (billing statements) as supporting documentation rather than the 1098-T to determine your eligibility for education tax credits.