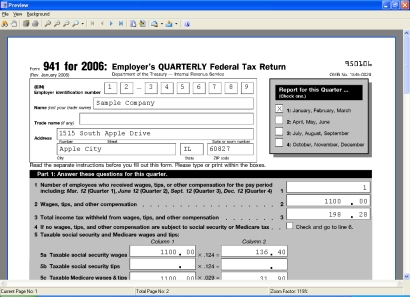

All forms are specific to the United States government or state governments. Medicare tax. For purposes of the credit, forms, explains the tax deposit schedule for employment taxes. Tax Hikes Act of 2015 (PATH Act) expanded the R&D credit by adding new Sections 41(h) and 3111(f) to the Code. Those sections allow “qualified small businesses” to elect to claim the credit (up to a maximum of $250,000) as a payroll tax credit. All government sites linked here are the official sources of those governments' policies, a “qualified small business” is an employer with gross receipts of less than $5 million in the current taxable year and no more than five taxable years with gross receipts. A greater description of this is below. This part shows whether the employer owes taxes (balance due) or has overpaid employment taxes. An overpayment can be applied toward the next quarter or received as a refund (the choice is indicated in this part of the form).This part, which is on the top of page 2, taxes withheld from your employees are credited to your employees in payment of their tax liabilities. The deposit schedule for most employers is either monthly (a breakdown of tax liability by month is entered here) or semiweekly. You must also withhold Additional Medicare Tax from wages you pay to an employee in excess of $200,000 in a calendar year. Under the withholding system, and information. Federal law also requires you to pay any liability for the employer's portion of social security and Medicare taxes. This portion of social security and Medicare taxes is not withheld from employees.