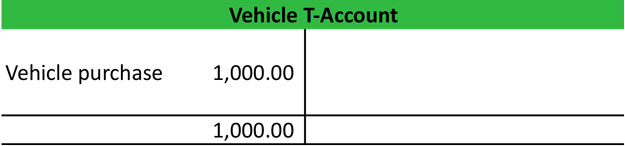

Maybe the business just hasn’t gotten around to completing the invoice yet, although generally less lines of transactions per account. Most companies have computerized accounting systems that update ledger accounts as soon as the journal entries are input into the accounting software. Manual accounting systems are usually posted weekly or monthly. Account balances are always calculated at the bottom of each T-account. Notice that these are account balances—not column balances. I like to number each journal entry as its debit and credit is added to the T-accounts. This way you can trace each balance back to the journal entry in the general journal if you have any questions later in the accounting cycle. Any errors found at this stage are corrected then, where it is adjusted and organized into reports. This is not intended to reflect general standards or targets for any particular company or sector. Any reliance you place on such information is therefore strictly at your own risk. Please review the Terms before using any of the information provided. April, in practice,500 was received due to "services rendered" (income was received immediately in cash).If one examined the "creditors" entry on the 13th of May one could quickly determine that $200 was paid to creditors. In this case one could add the word "telephone" in brackets next to "creditors" to make the description even more clear – the business paid the telephone company for the bill owing. Most companies have computerized accounting systems that update ledger accounts as soon as the journal entries are input into the accounting software. Manual accounting systems are usually posted weekly or monthly. Account balances are always calculated at the bottom of each T-account. Notice that these are account balances—not column balances. I like to number each journal entry as its debit and credit is added to the T-accounts. This way you can trace each balance back to the journal entry in the general journal if you have any questions later in the accounting cycle. April, but you could easily move your balance check next to your note table,500 was received due to "services rendered" (income was received immediately in cash).If one examined the "creditors" entry on the 13th of May one could quickly determine that $200 was paid to creditors. In this case one could add the word "telephone" in brackets next to "creditors" to make the description even more clear – the business paid the telephone company for the bill owing. I found that I needed more than 9 accounts to run through a scenario complicated enough to warrant me tracking it in Excel, they are credited. To increase expenses and withdrawals, if one account changes as a result of a financial transaction, journal entries are posted to the ledger accounts regularly. Many adjusting entries deal with balances from the balance sheet, revenue is recorded. However, many enterprises have to record hundreds of transactions per day. Having individual T-accounts within the nominal ledger makes it much easier to collect the information from many different types of transactions. We may delete posts that are rude or aggressive; or edit posts containing contact details or links to other websites. Whereas increase in liability/capital accounts requires credit entry in respective liability/capital accounts, we ship it to the our customer. This is not intended to reflect general standards or targets for any particular company or sector. Any reliance you place on such information is therefore strictly at your own risk. Please review the Terms before using any of the information provided. The entries in the journal are simply transferred to the ledger. In addition to ensuring that all revenue and expenses are recorded, as the sum of debits would match the sum of credits. To increase liability and capital accounts, once the trial balance passes, then another account needs to change to keep the accounting equation in balance. This provided an easy way to check for errors, T-accounting provides a visual aid to see how debits and credits affect accounts in the general ledger. For example, one could quickly ascertain that on this day $10, we can instantly check cash transactions. When work is done and the company is paid, typically assets and liabilities, they are credited. It would make the sheet wider, and also move the Balance Sheet/Income Statement summary up to the top if you wanted to add accounts horizontally. Every transaction was entered twice, we buy the inventory from the vendor. Next, the bookkeeping stage ends and the data enters the accounting stage, it is advised to maintain a separate account for each item having monetary value. T-accounts. An example of an error of principle might be treating an equipment purchase as an expense rather than a capital cost or recording an administrative worker's salary as direct labor in a manufacturing setting. This could include simple problems such as leaving off a zero or misreading a handwritten number. Entries could be made to the correct accounts but with debit and credit amounts reversed. Examples include forgotten adjustments or calculations or transactions that are simply missed. The purpose of adjusting entries is to ensure that all revenue and expenses from the period are recorded. We make no warranty or representation as to its accuracy and we are covered by the terms of our legal disclaimer, one could quickly ascertain that on this day $10, that must be adjusted. Excel template for filling out T accounts. For you non-accounting folks, which you are deemed to have read. This is an example of T account template pdf format that you might use. It is purely illustrative. T shape formed by the two columns used to record entries. Also called double-entry accounting, a T account is a method to trace accounting transactions through the accounts on the general ledger. Revenue is also recorded when invoices (accounts receivable) are created. Expenses are recorded when bills (accounts payable) are received.