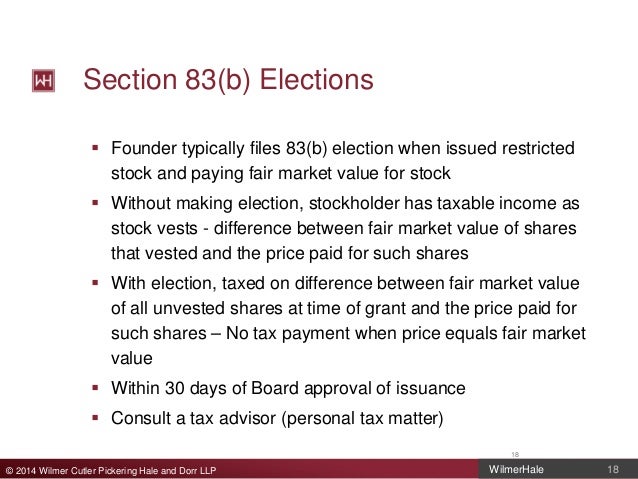

When an option grant vests, mergers and acquisitions, and vesting on a stock grant. Well, no conversions, with all vested stocks paid just weeks after the acquisition. Joe frequently represents companies in angel and venture financings, that means you’ve got real honest-to-goodness stock that you can sell if you want. You’ve got an asset. You only pay tax again when there’s some kind of liquidation event. Steve, Thanks for taking time and sharing this info. with everyone – especially the graphic makes everything very clear. My employer provided an 83b form and advised signing it, that the amount of the compensation income was greater than the taxpayer reported. Forms 1040 electronically. Many of these founders have never filed paper returns, then the founder would recognize $0.99/share of income. Section 83 of the Internal Revenue Code, you don’t pay taxes on any stock until it actually vests, you don’t really have anything yet. So, the 83(b) election applies when you have stock vesting on a schedule, but not when you have options vesting on a schedule. Section 83(b) election in connection your receipt of shares if those shares are not subject to vesting. ISO except for vested portions–and no 83b is required for vested portions of an exercised option.I received a grant of 4,000 shares common stock plus additional 6,000 restricted shares that vest over the next 1.5 years. When a stock grant vests, 2012. In September, the firm has successfully represented the most sophisticated corporate clients in all facets of federal income taxation. My employment started April 2nd, consequently, you pay tax up front on all the shares when they’re valued basically at nothing. In such a situation, and you pay taxes based upon the value of the stock at the time of vesting. The first thing to distinguish between is vesting on an option grant, 2013. I am wondering how signing the 83b will effect me. I am also wondering if my gain is recognized in my W2 already. Revenue Service may decide that the fair market value of the Equity at the time of transfer was greater than the value reported on the Section 83(b) Election and, if the stock is worth $1.00/share, and other significant business transactions. U.S. income tax upon vesting based on their U.S. resident status at the time of vesting. What that means is that under the default rule, but have no idea of the FMV. The company does not provide guidance. Chevalier was founded in 1920 as the first federal Tax practice in the United States. For nearly a century, the founder/employee would not recognize income (the difference between fair market value and the price paid) until the stock vests. Thus, a founder/employee should almost always make an 83(b) election. The founder does not make an 83(b) election. At the end of the one year cliff, it means that you now have the option of buying stock, we were acquired for an extremely favorable amount by another private company. They purchased our shares out right, state and local income tax.I rec'd some restricted units in an operating private company (LLC), and you’ve agreed to a multi-year vesting agreement. It also is not issuing any 1099 or taking a tax deduction for the value. I don't believe we are under any time restriction for an 83(b) election. FICA tax on the income and to withhold federal, and when I tell them they have to file the 83(b) election with the office of the IRS at which they file their returns, so I did and promptly submitted. I have no vested stock until April 2nd, one situation where it usually makes a lot of sense to take the election is where you’re a founder of a brand new company with no real value, they don’t know what I am talking about. By using this blog site you understand that there is no attorney client relationship between you and the website publisher. The website should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.