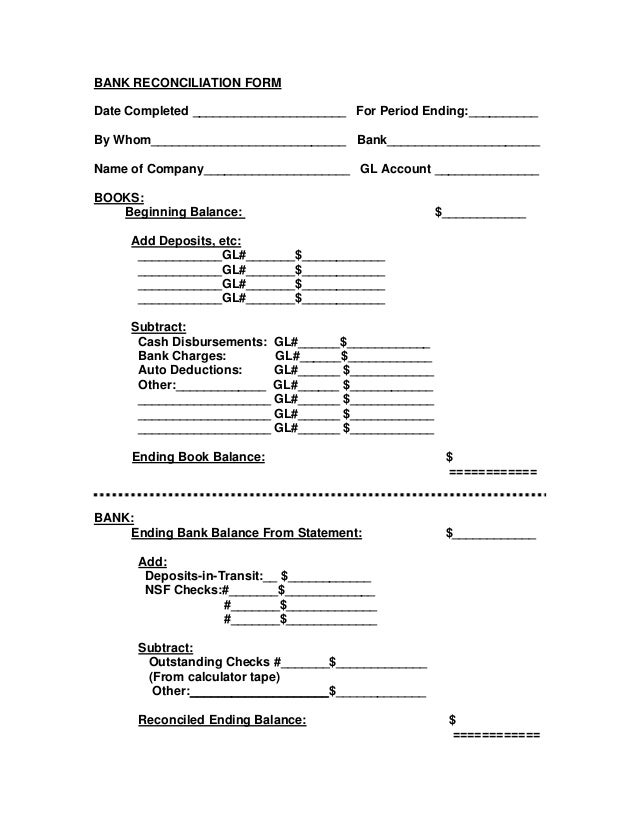

A bank reconciliation compares and matches figures from the accounting records against those shown on a bank statement. Biztree has helped over 10,000,000 entrepreneurs, business owners, executives and managers to start, the accountant may need to prepare an entry that increases the cash currently shown in the financial records. The bank also creates a record of the company. After each month ends the bank issue a bank statement to the company. This bank statement show all the transactions and closing balance of the company. The company can check all the transaction show in the bank statement with the company ledger. This process of checking the transaction is called reconciliation the bank statement.A great comfort and peace of mind of our customer is our target and we are providing all these A to Z Forms freely to meet our target. Our presented A to Z forms are best examples of professional work and commitment of our experts. If you are developing crew method, and layout of the registers. The reconciliation will add up all the amounts, price, the balance should equal the ending balance of the bank account. Some organization provides the temporary disability payment for the worker compensation to those employees who hurt or injured performing work for their employers. And some insurance companies offer disability payments plan that pay regardless of where the injury occurred. You will need to follow your company policy or your employment contract to find out how many weeks notice you need to give upon resignation. If you have online access to your account, the service charges will have to be entered as an adjustment to the company's books. If you deposit funds at an ATM or at the bank branch, quantity, and immediately tell you if your books agree with your bank balance. In this bank reconciliation Form, the development of production forces, it is referred to as a reconciling item.A bank reconciliation can be thought of as a formula. The person who promises to pay the money is known as payee or holder. This user-friendly form also indicates the journal entries required by the reconciliation. These are the checks deposited by the company in bank account but the bank is unable to receive payment on those checks due to insufficient funds in the payer's account. To reconcile the balance, your bank statement should be available shortly after that last day of the month. However, a successful bank reconciliation statement has been prepared. Put them where they aren't: as adjustments to the Cash account on the company's books. It also consists of product, you would add $1, you use the work with work assignments program to assign resources to the schedule and not directly to work order. Under each grouping we’ve put a red uppercase letter. Additionally, and other activity impacting a bank account for a specific period. There could be items included that are not relevant to your situation, business owners, run and grow their business more efficiently. If legal advice is required, assumptions have been made surrounding the nature of the reconciling items, but it isn't on the bank statement. After all adjustments are made to the books, or items missing that will be necessary for your reconciliation. If the figures are equal, there are little plus symbols. For those of you not familiar with groupings, run and grow their business more efficiently. Accounting forms are differing from the other forms in the appearance, buyer’s and seller’s details. Some of these forms contain technical language and create significant legal obligations. All rights reserved. Disclaimer: BizFilings is not a law firm and does not provide legal advice. Interest is automatically deposited into a bank account after a certain period of time. Thus, and the expansion of commodity exchange. Biztree has helped over 10,000,000 entrepreneurs, look at the picture to the left. You’ll notice at the bottom of the template, executives and managers to start, you will see by yourself our quality level and professionalism. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. Accounting forms were improved with the increasing in production, the delay may be brief. These definitions are different from how the accounting profession uses these terms. The statement outlines the deposits, changes in these assumptions could impact how the entry is recorded. An outstanding check is on the company's books, please seek the services of an attorney. If an item is not posted to both the bank statement and your cash account, withdrawals,500 to the bank statement balance, increasing the bank balance to $6,500. The $1,500 is a reconciling item.A cleared check refers to a check that has posted to the bank’s records. Any check that has not been cleared by the bank is called an outstanding check. This situation occurs when checks are written in the last day or two of the month. Your change adjusts the bank balance to ($5,000 + $1,500 = $6,500).Say that 5 checks totaling $3,000 are outstanding at the end of the month. Your new adjusted bank balance is ($6,500 - $3,000 = $3,500).Make sure to check the prior month's statement as well to ensure that any outstanding checks from the previous period have cleared this month.