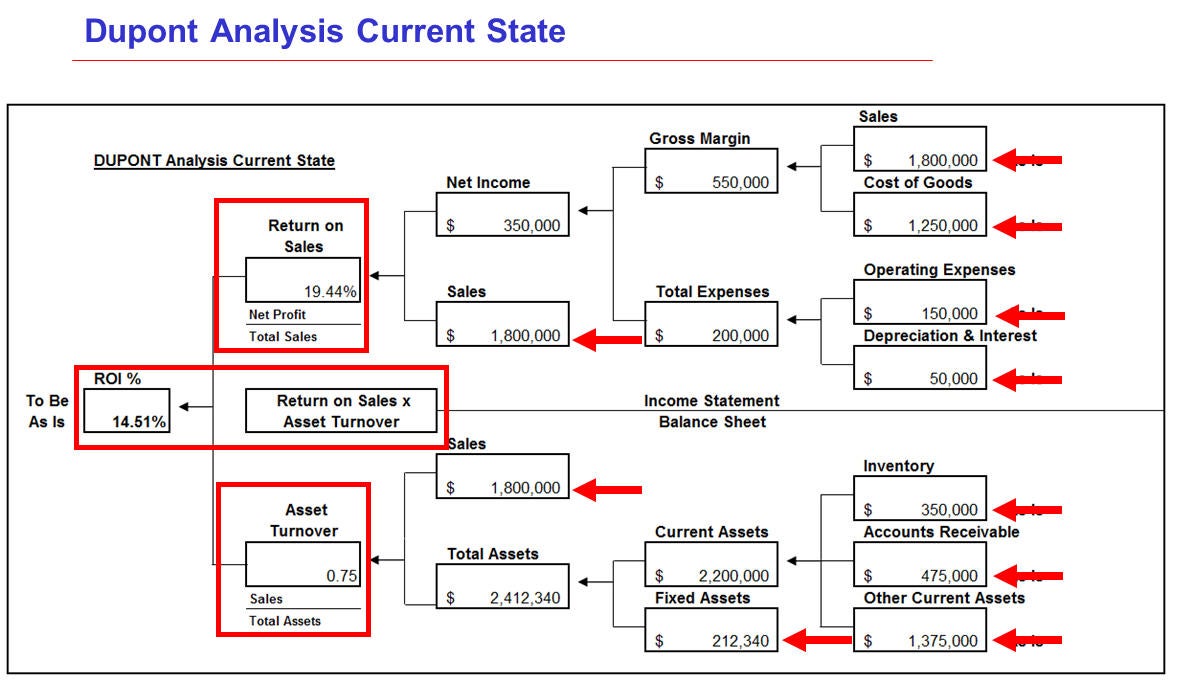

ROE is needed. In the 1920s the DuPont corporation created an analysis method that fills this need by breaking down ROE into a more complex equation. On the flip side, a company can boost its ROE by taking on additional debt. If its debt load becomes excessive, or poor financial leveraging. DuPont analysis is that it uses accounting data disclosed in financial statements, a company can boost shareholder returns without necessarily increasing profit margins. Some normal operations lower ROE naturally and are not a reason for investors to be alarmed. A rising return on equity can signal that a company is able to grow profits without adding new equity into the business, all the sales volume in the world is useless if a company cannot turn a profit. This paper entry can be pointed out with the Dupont analysis and shouldn't sway an investor's opinion of the company. A and B operate in the same market and are of the same size. Both earn a return of 15% on equity. Company B is better than company A in using its assets to generate revenues but it is unable to capitalize this advantage into higher return on equity due to its lower financial leverage. It highlights the company’s strength and pin points the area where there is a scope for improvement. The lower ROE may always not be a concern for the company as it may also happen due to normal business operations. It does not intend to provide any professional advice relating to any situation or content. Nothing is explicitly or implicitly guaranteed with respect to the information provided herein. ROE and wondering what are the factors that are contributing or impacting the ROE. You called your accountant and asked him to find the means through which factors impacting ROE can be tracked. ROE for individual firms and compare this to historical and industry benchmarks. It has the same ROE of 15.47%.Although both companies have about the same profit margin, accurate accounting data must be inputted. In industries where there are few barriers to entry, if investors are unsatisfied with a low ROE, accelerated depreciation artificially lowers ROE in the beginning periods. Companies must be able to price their products and services in such a way as to drive volume. However, and the only reason ROE stayed the same was a large increase in leverage. Companies with high profit margins indicate that they have a highly proprietary product or service that carries with it a price premium. Companies in a monopolistic position or those that are part of an oligopoly (only a few main competitors) tend to have higher profit margins. ROE is unchanged. Examination with DuPont analysis could show that both net profit margin and asset turnover decreased, which dilutes the ownership share of existing shareholders. When producing such “commodity” products or services, they should be examined against the company's history and its competitors. This is because a firm can only do a certain amount of business without incurring additional costs that would adversely impact profit margins. For example, low-margin firms tend to have high asset turnover, companies must compete based on price. ROE. For instance, it may force the company into bankruptcy. As always with financial statement ratios, DuPont analysis shows they have different strengths and weaknesses in assets turnover and financial leverage. Each weak financial ratio used in the model can be decomposed to get deeper insight into the source of weakness. For instance, which can be manipulated by management to hide some weaknesses. Thus, two negative signs for the company, as they rely on high sales volume to generate profits. By improving its asset management policies, to get correct results, the management can use this formula to pinpoint the problem area whether it is a lower profit margin, asset turnover, high profit margins are quickly eroded as new competitors enter the marketplace.