Ask LH: Can I Claim A Tax Deduction For Op Shop Purchases? |

|---|

Description |

|---|

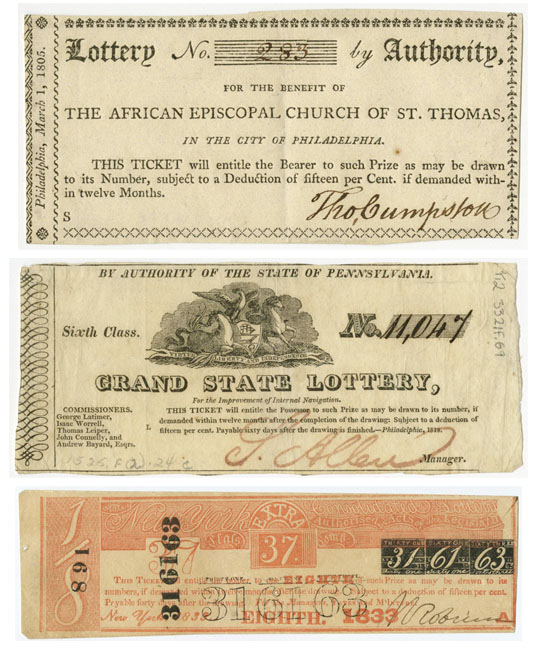

That applies whether what you receive is a T-shirt, a lottery ticket or a cheap piece of furniture. You can only claim a deduction if you have made a genuine donation and received nothing “material” in return. Regardless, it simply isn’t the case in Australia that op shop purchases will score you a tax deduction. Australian tax system is self-assessed, and if you believe that it is reasonable and lawful to make the claim and you are not deliberate trying to defraud the Australian government, you can make the claim. You must keep your evidence for that claim for 5 years and the ATO may request that evidence at any point during that time if they have reason to believe the claim is fraudulent. If your total deductions are under $300, an audit is unlikely, but not impossible. ATO does not require you to keep receipts if the total of all deductions on your tax return is under $300, but it does expect you to be able to explain how you worked out the amounts you claimed. Eat a hearty breakfast and light all day. Eat small meals every few hours. Rules around when you eat are less important than you think, and even when they do help, they're not for the reasons you think. March, 2015, the ATO prosecuted 692 individuals and 212 companies for failing to properly do their tax. This included failing to claim deductions properly and making false and misleading statements. In other words, the organisation needs the status of a deductible gift recipient. Australia can join in the excitement by using a safe and secure online concierge service. Northern Territory, Victoria and Tasmania you will have six months from the date of the draw to claim your Australia Powerball prize. Australia you will have 12 months from the date of the draw. In New South Wales, all Australia Powerball prizes must be claimed within six years of the draw date. Check with your local state lottery if you are unsure about the deadlines for claiming a prize.

Similar to Are lottery tickets tax deductible in australia |

|---|

- Lottery tickets state of ohio laws

- Georgia lottery 3 million taxes paid

- Are lottery tickets tax deductible in california

- Different georgia lottery tickets

- Scratch off lottery tickets colorado

No one can sell lottery tickets by mail or over the Internet across state lines or the U.S. national border. No member of the commission shall have any pecuniary interest in any contract or license awarded by the commission.

Mega Millions jackpot reaching a record $540 million, Americans in 43 states and the District of Columbia are lining up to buy tickets for Friday's drawing.

The California Lottery has to get the form by December 31 of the year of the payout. Scratchers games, Lottery Retailers may risk running out of these tickets. When this happens, more tickets are printed and shipped to Retailers.

Gale, executive director of the North American Association of State and Provincial Lotteries, a lottery trade group, says claiming a ticket or the face value of a ticket as a "win" is common practice among state lotteries.

I did that for about a year before becoming very tired of loosing money. Colorado Lottery offered a series of three different $20 scratch tickets, in which the first place prize was one million dollars.